Matching the Gross Profit in the Sales Register and Stock Summary and Profit & Loss A/c

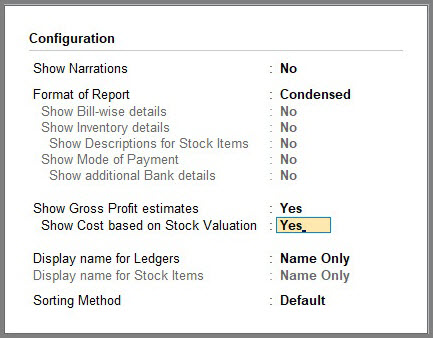

The transaction level Gross Profit of Sales Register can be matched with Profit & Loss A/c and Stock Summary reports by enabling the option Show Cost based on Stock Valuation in the Sales Register F12 (Configure) screen.

Consider that your business deals with the two stock items – Books and Dictionaries. In TallyPrime, you have created the stock item master with the following settings:

Books:

- Opening Balance = Quantity 100, at the Rate of Rs. 150 each.

- Costing Method = FIFO

Dictionaries:

- Opening Balance = Quantity 70, at the Rate of Rs. 200 each.

- Costing Method = Avg Cost (the default setting for stock items).

Say you have made the following transactions with your parties:

Purchase:

- 50 books at the rate of Rs. 170 each

- 25 Dictionaries at the rate of Rs. 210 each.

Sales:

- 50 books at the rate of 190 each.

- 25 Dictionaries at the rate of 225 each.

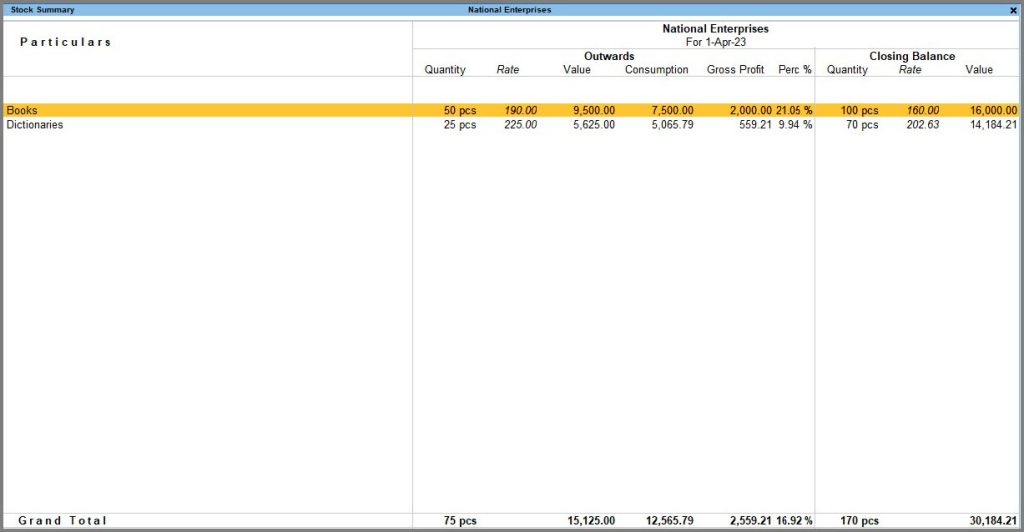

Now, open the Stock Summary and Sales Register reports.

- Press Alt+G (Go To) > Stock Summary.

Alternatively, Gateway of Tally > Stock Summary.

The Stock Summary report appears, as shown below:

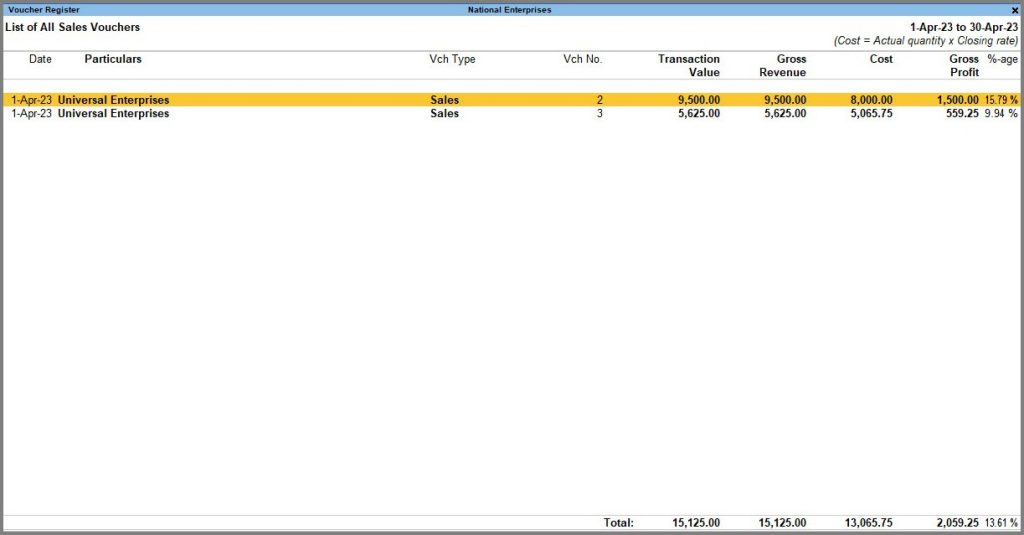

- Press Alt+G (Go To) > Sales Register.

Alternatively, Gateway of Tally > Display More Reports > Account Books > Sales Register.

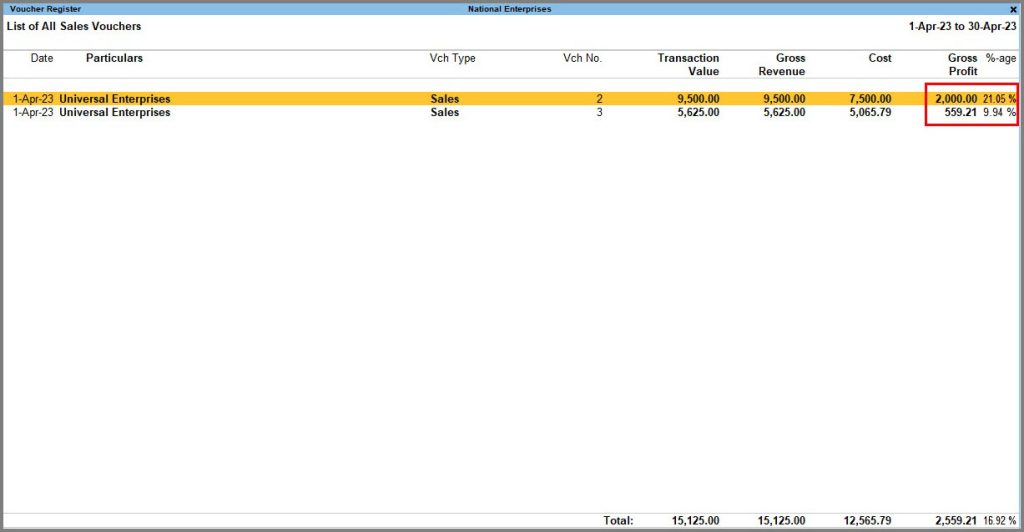

The Sales Register report appears, as shown below:

The Gross Profit shown in your Sales Register will be different from the Gross Profit shown in Stock Summary.

This is because the Stock Summary report by default considers the gross profit based on the Opening Balance for Books. It does not calculate the profit based on the purchase cost for the stock item Books, which is set as FIFO.

Configure the Sales Register report to display the gross profit based on the Stock Valuation method of stock items. In this case:

Notice that the Gross Profit in the Sales Register matches with the Stock Summary report after enabling the option. The Sales Register appears, as shown below:

The total Gross Profit of Sales Register will not match with Stock Summary and Profit and Loss account reports in

the following scenarios:

- If batches and godowns are enabled for the stock items.

- If there are discounts and additional costs involved in the sales transactions. For example, lighting charges

(for factory) will not be included in the cost of the stock item. Since this is a direct expense, it will be included in the Profit and Loss A/c. - If the actual and billed quantities of a sales voucher are different.

- Inventory Vouchers are not considered to calculate the Gross Profit in Profit and Loss A/c.

- In the financial year 2022-23, an accounts-only company was maintained, and the stock values were updated in the ledger. In financial year 2023-24, if you want to maintain accounts with inventory, there will be differences in Gross Profit of Sales Register with Stock Summary and Profit & Loss A/c.

Reasons for Difference in Values of Sales Register and Profit & Loss Account

The Sales Register displays complete Sales value including the Tax Amount, whereas the Profit & Loss A/c displays only the Sales value. This results in a difference in the values of Sales Register and Profit & Loss A/c reports.

Consider the following example of Sales invoices recorded with and without Tax to view the impact on Sales Register and Profit & Loss A/c.

- Record a Sales invoice without tax as shown below:

- Record a Sales invoice with GST as shown below:

- Compare the values in Sales Register and Profit & Loss A/c.

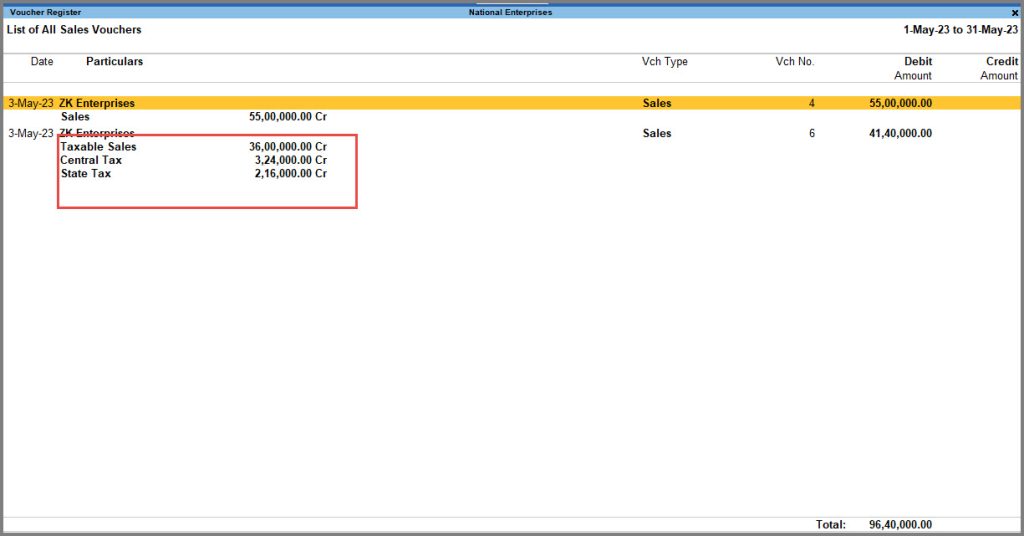

- Press Alt+G (Go To) > Sales Register.

Alternatively, Gateway of Tally > Display More Reports > Account Books > Sales Register.

The total value includes GST.

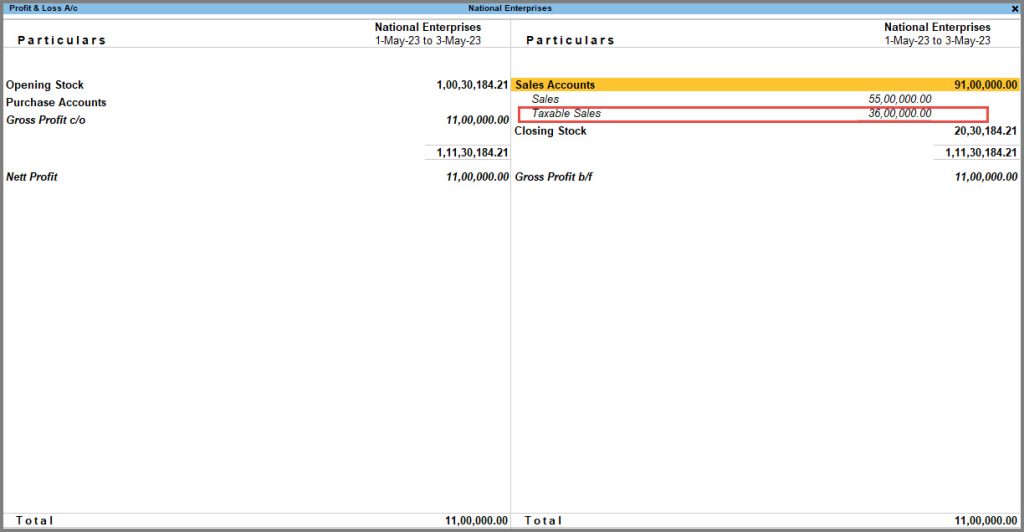

- Press Alt+G (Go To) > Profit & Loss A/c.

Alternatively, Gateway of Tally > Profit & Loss A/c.

The Sales Accounts displays the values without GST.

- Press Alt+G (Go To) > Sales Register.

Such discrepancies may arise in reports like Sales Register, Stock Summary and Profit & Loss A/c and you can resolve them by following the procedures given above. This will ensure accuracy and consistency of maintaining your company data.

Display Comparative Sales Register

TallyPrime enables you to compare details of a report with another by displaying details in a new column as per your selected parameters. For example, you can compare sales of two different months or sales of a month with the purchases, and even alter the parameters in the column as required. You can also compare similar data of two or more companies stored in the same data directory. Once you have compared the details as per your requirement, you can delete unnecessary columns.

New Column

As a business owner, in some scenarios, you will want to compare your current quarter’s sales with that of the last quarter or the current month’s sales with that of the previous month or any month. Also, you will be doing a comparison of sales with other business transactions like purchases to know whether your purchases are in order with that of sales transactions.

In TallyPrime, you can compare an existing report with another by adding a new columnar report and configuring it with the period, currency, and voucher details as required.

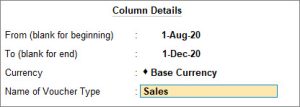

- On the Sales Register screen, press Alt+C (New Column) and press Enter.

- Fill in the Column Details as required and press Enter.

In the comparative sales report shown below, sales from 1-April- 2020 to 31-March-2021 are compared with sales from 1-August-2020 to 1-December-2020.

If you want to add another column, press Alt+C (New Column) and enter the Column Details as required and press Enter. Similarly, if you want to alter any Column Details, select the column and press Alt+A (Alter Column). You can also delete a column by selecting it and pressing Alt+D (Delete Column).

Auto Column

In your business, you will often want to compare sales of various periods, and every time creating a New Column can be a tedious task. TallyPrime enables you to create Auto Column to create columns automatically based on selected periods like Yearly, Half Yearly, Quarterly, Monthly, and so on.

Auto column feature in TallyPrime enables you to repeat multiple columns in a sales register. You can select the period as Daily, Monthly, Quarterly, and so on, as required.

- On the Sales Register screen, press Alt+N (Auto Column) and press Enter.

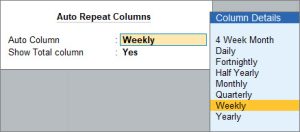

- On the Auto Repeat Columns Screen, select options in Auto Column and Show Total column filed as required and press Enter.

Shown below is an example of Auto Column feature with Auto Repeat Columns set to Weekly and Show Total column set to Yes. Similarly, you can select Auto Column to Daily, Monthly, Quarterly, and so on, as required. You can also set the Show Total column to Yes or No.